Capital Crest’s partnerships with lenders and carriers propel its life insurance premium finance platforms to among the top in the industry. Capital Crest Financial Group offers its clients and advisory partners years of expertise and experience coupled into two areas of specialization: (1) individual financing, including (i) accumulation and (ii) estate planning; and (2) business life insurance.

See more information below to determine if premium finance is the right fit for your or your clients.

“Premium Finance may help clients that need Large amounts of life insurance but don’t want to immediately liquidate assets to make large premium payments”

Premium financing may be an effective strategy for affluent individuals to meet their wealth transfer objectives. Many affluent individuals have a need for life insurance but have illiquid estates, or would choose alternative funding solutions.

Premium financing can represent a current source of capital for life insurance premiums. Premium financing can also be a source for premium dollars until the client has an identified liquidity event (e.g., sale of business) in the future. Wealthy individuals can be very good at developing a high return on their investments. For these individuals, borrowing may make sense if they expect their assets/investments to continue generating positive arbitrage over the loan interest rate.

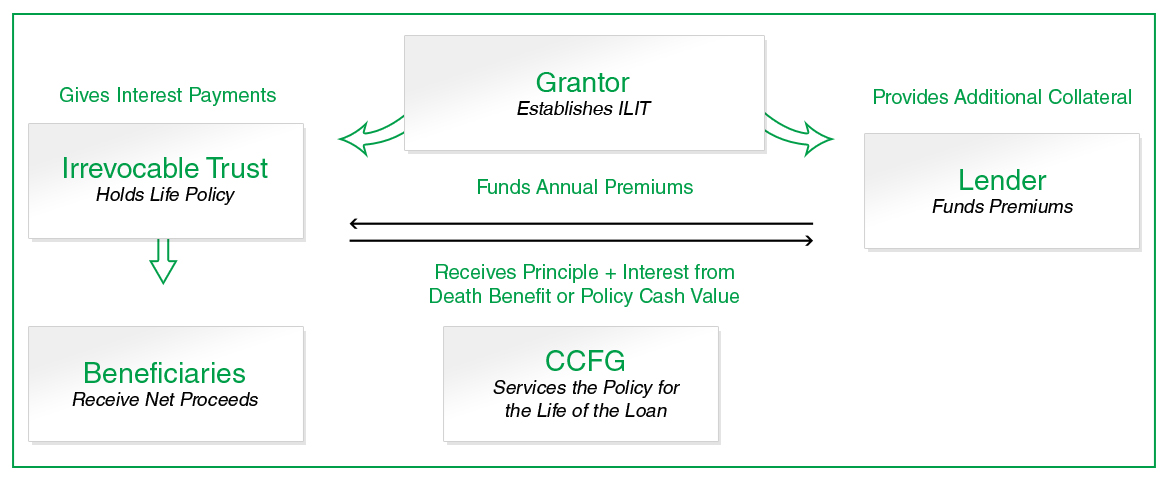

Mike is a family man by night and an executive of a large company by day. Like many in Mike’s situation, he has an ambition to protect his legacy and is troubled about how to preserve his family’s liquidity against potential estate tax exposure and what would happen in the event of an untimely passing. Mike has already used his lifetime gift tax exemption and is seeking life insurance. Working in partnership with his family’s attorney and his investment, banking, and insurance advisors, they have come up with a long-term liquidity solution by creating an Irrevocable Life Insurance Trust (ILIT) to hold three life insurance policies, one for himself, one for his wife, and a survivorship (second to die) policy on he and his wife. Since Mike has used all of gifting exemption, if the ILIT were to self-fund or if Mike was to gift the annual premiums on the policies, every contribution would be subject to gift taxes.

To reduce future gift tax consequences, Mike’s advisory team suggests a premium finance strategy to fund the annual premiums on the life insurance policies. In this strategy, the loan will accrue interest in order to prevent any gift tax exposure on future contributions to the ILIT (clients who have yet to use their lifetime gift tax exemption are encouraged to service the interest up to their annual gift tax exemption for enhanced results) and the net insurance death benefit will not be included in Mike’s gross taxable estate. By carefully evaluating Mike’s goals and financial situation, Mike’s advisors were able to suggest a solution that can solve Mike’s legacy issues and potentially saves Mike and his family millions of dollars in future estate taxes.